Copyright 2012 Campbell R. There are three components to calculate simple interest.

/GettyImages-481269242-bc3864796b5043c8a4f082b02118584b.jpg)

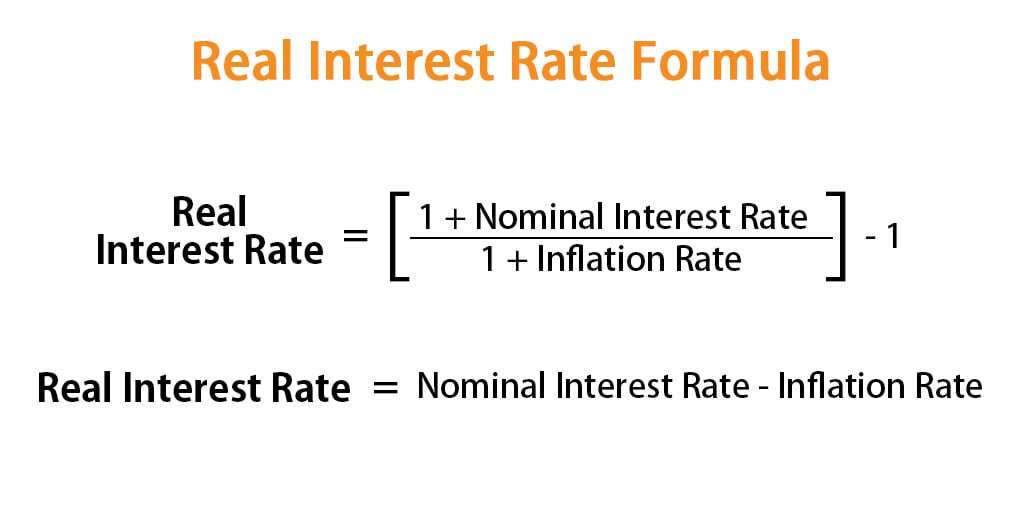

Understanding Real Vs Nominal Interest Rates

When we borrow money we are expected to pay for using it this is called interest.

Exact interest rate definition. The actual real or effective interest rate is the rate that will discount all of the future cash receipts back to the amount of cash paid to buy the bond. The interest rate is typically stated as a percentage of the principle per period of time for example 18 percent per year or 15 percent per month. Here P denotes the principal r represents the rate of interest for one year and t is the time in years.

Ordinary simple interest is a SI that takes only 360 days as the equivalent number of days in a year. The real interest rate is the rate of interest an investor saver or lender receives or expects to receive after allowing for inflation. It can be described more formally by the Fisher equation which states that the real interest rate is approximately the nominal interest rate minus the inflation rate.

In accordance with the Philippine Accounting Standards definition effective interest rate EIR is the rate that exactly discounts estimated future cash flows through the life of the loan to the net amount of loan proceeds BSP Circular No. The interest rate is the cost of debt for the borrower and the rate of return for the lender. If for example an investor were able to lock in a 5 interest rate for the coming year.

For example if one holds a bond with a face value of 1000 and a 3 interest rate payable each quarter one receives 30 each quarter. The percentage of the value of a balance or debt that one pays or is paid each time period. It can also mean the market interest rate the yield to maturity the discount rate the internal rate of return the annual percentage rate APR and the targeted or required interest rate.

The interest rate specifies the rate at which interest accumulates. Interest rate also applies to the percentage charged periodically on credit card balances. The interest rate effect is changes experienced in macroeconomic indicators caused by an alteration in the interest rates.

Effective interest rate EIR is the rate that exactly discounts estimated future cash flows through the expected life of the financial assetliability to the gross carrying amount of a. It can also refer to the modification in the interest rate originated by a change in the overall price level. Interest rate definition the amount that a lender charges a borrower for taking out a loan typically expressed as an annual percentage of the loan balance.

Simple Interest Definition and Calculation. Yes it is used to highlight the cost of credit so that you dont focus on the rate alone but include fees and charges AND rate changes where you have a fixed rate reverting to a variable rate however the variabillity of any variable rate loan will mess with the ACTUAL cost. Formula for calculating simple interest.

Your mortgage interest rate might be fixed which means it stays the same throughout the duration of your loanYour mortgage interest rate might also be variable which means it might change depending on market rates. Your interest rate is the percentage you pay to borrow money from a lender for a specific period of time. It impacts the economy by controlling the money supply.

The actual or real interest rate on a bond can be calculated by using present value software or a financial calculator. This contrasts with ordinary interest which is calculated on a 360-day basis. The basic formula used to calculate simple interest is.

Definition of Effective Interest Rate. The money to be repaid is usually more than the borrowed amount since lenders require compensation for. Interest is found in the income statement but can also actually earned on an investment or paid on a loan as a result of compounding the interest over a given period of time.

The interest rate is the percent of principal charged by the lender for the use of its money. Principal the amount of money borrowed interest rate and time. Since the time period is 193 days we need to convert the number of days into an equivalent number of years.

This term is applied differently depending on the context. Interest paid by a financial institution that is calculated on a 365-days-per-year basis. What Does the Interest Rate Effect Mean.

This interest rate is also known as the yield to maturity yield and. On the other hand exact simple interest is a SI that takes exact days in 365 for a. The Effective Annual Rate EAR is the rate of interest Interest Expense Interest expense arises out of a company that finances through debt or capital leases.

The effective interest rate is the true rate of interest earned. Interest that is paid solely on the amount of the principle is called simple interest. The percentage of the interest rate remains constant usually but the amount one pays or is paid.

Definition of Exact InterestInterest paid based on the basis of a 365-dayyear schedule by a bank or other financial_institution as opposed to a 360-day basis ordinary interestDifference can be material when large principal sums of money are involved. Interestthat is calculated and therefore repaid on the basis of a 365-day year that is an actual year as opposed to a 360-day year which is used in some calculations.

Real Interest Rate Formula Calculator Examples With Excel Template

/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition