Ii the approximate real interest rate a it 6 πt 1bit 10 πt 5cit 50 πt 45 Solution. Definition What is real interest rate.

Real Interest Rate Formula Calculator Examples With Excel Template

Exact interest is a process of calculating the interest on a debt based on a 365 day year.

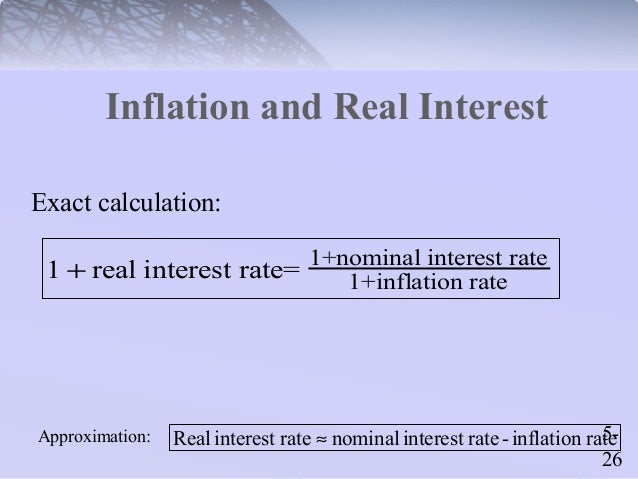

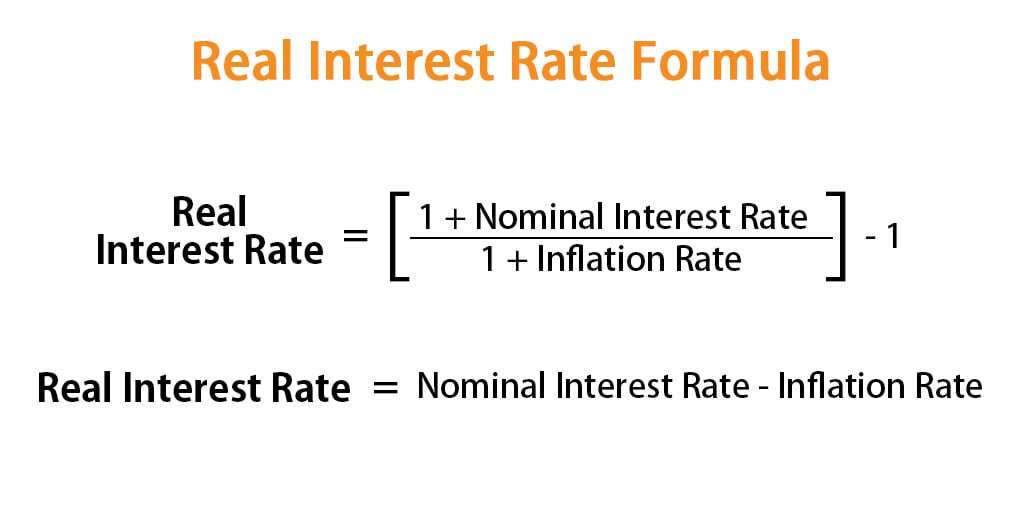

Exact real interest rate formula. Real Interest Rate Nominal Interest Rate Inflation Rate. 5 c r 345. The formula for the real rate of return can be used to determine the effective return on an investment after adjusting for inflation.

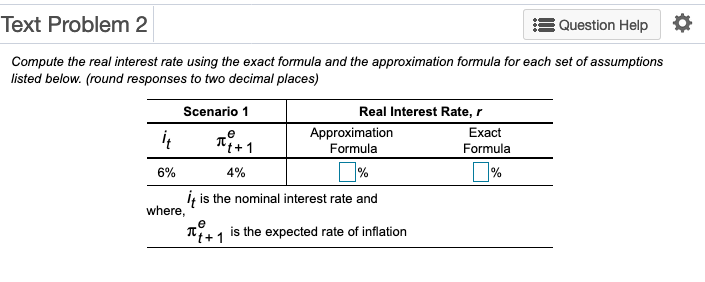

Compute the real interest rate using the exact formula and the approximation formula for each set of assumptions listed below. I Prt. Understanding whether the lender uses an exact interest model is important to understanding exactly how a given rate of interest is applied to.

Round responses to two decimal places it T 1 Exact Formula Scenario 1 Real Interest Rate r Approximation Formula 4 - 1 it is the nominal interest rate and 3 where The 1 is the expected rate of. For example if a loan has a 12 percent interest rate and the inflation rate is 8 percent then the real return on that loan is 4 percent. Real interest rate nominal interest rate inflation rate.

What is the Formula to Calculate the Interest Rate Formula. Here P denotes the principal r represents the rate of interest for one year and t is the time in years. If an investor expected a 7 interest rate with inflation at 2 the real interest rate would be 5 7 minus 2.

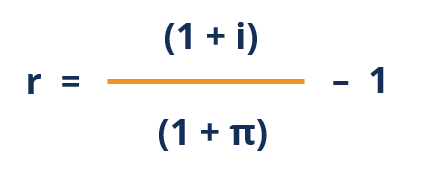

This interest rate is also known as the yield to maturity yield and. Rt it πe t a r 495. The real interest rate is the interest rate adjusted for the inflation rate.

R_R fracleft 1 008 rightleft 1 003 right - 1 004854 485. Real interest rate nominal interest rate inflation rate. The real rate of return formula is the sum of one plus the nominal rate divided by the sum of one plus the inflation rate which then is subtracted by one.

The actual or real interest rate on a bond can be calculated by using present value software or a financial calculator. The interest rate for a given amount on simple interest can be calculated by the following formula Interest Rate Simple Interest 100Principal Time. To find the real interest rate we take the nominal interest rate and subtract the inflation rate.

Can the real interest rate ever be negative. For example if a loan has a 12 percent interest rate and the inflation rate. This is in contrast to other methods that may base the interest on other time periods such as a 360 day basis.

It really doesnt matter which one we adjust but it tends to be easier to think in current dollars so we will convert the nominal interest rate into a real rate. 5 b r 476. The actual real or effective interest rate is the rate that will discount all of the future cash receipts back to the amount of cash paid to buy the bond.

Simple Interest Rate Principle Rate of Interest Time Period years 100 You are free to use this image on your website templates etc Please provide us. Formula How to calculate real interest rate. To find the real interest rate we take the nominal interest rate and subtract the inflation rate.

What is the exact real rate of interest rate. The interest rate formula is Interest Rate Simple Interest 100Principal Time. For example if a loan has a 12 percent interest rate and the inflation rate is 8 percent then the real return on that loan is 4 percent.

The basic formula used to calculate simple interest is. Round responses to two decimal places Scenario 1 Real Interest Rate Exact Approximation 4 Formula Formula 3 2 1 09803 is the nominal interest rate and where 17 is the expected rate of inflation Exact Formula 4 16 Scenario 2 Real Interest Rate Approximation Formula 8 1 is the nominal Interest rate and 1 is the expected rate of inflation where. I the exact real interest rate.

To find the real interest rate we take the nominal interest rate and subtract the inflation rate. Real interest rate nominal interest rate inflation rate. Rt 1it 1πe t 1.

The nominal rate is the stated rate or normal return that.

Solved Question Help Text Problem 2 Compute The Real Chegg Com

Return And Risk Returns Nominal Vs Real Holding