The loan was granted on 20 May 2007 and matures on 14 September 2007. Approximate time Assumes that every month contains 30 days.

2 1a Simple And Compound Interest Finite Math

May 6 2015 126 365 491 date of the loan.

Exact interest approximate time formula. - Uses only 360 days. The Rule of 72 gives an estimation of the doubling time for an. As stated this is only an estimation as a 6 rate would take 1190 years using the actual doubling time formula.

To calculate the SI for a certain amount of money P rate of interest R and time T the formula is. Ordinary interest is based on the assumption of thirty days in each month of the calendar year. He was born March 10 1940.

In which SI simple interest. Loan Amount in dollars and cents x Interest Rate x Time in days Total Interest You must select the values to enter the Starting Month Day and Year and the Ending Month Day and Year for the time of loan. 12 2014 316 175 days The Ordinal of Each Day of the Year If two transaction dates are given the following simple interests can be computed.

4- Exact interest and approximate time Example. To determine the exact time date of payment. Continuously Compounded Interest Formula.

ORDINARY INTEREST AND EXACT INTEREST When time is expressed in days interest could either be ordinary interest or exact interest. Continuously compounded interest is the mathematical limit of the general compound interest formula with the interest compounded an infinitely many times each year. The Simple Interest Calculation Formula is.

A person obtains a RM3500 loan from a bank that charges an interest of 725. Ordinary simple interest for exact. The Formula for simple interest enables us to find out the interest amount if the principal amount rate of interest and time duration is given.

Hence 7 where D is the number of days or the time expressed in days. Formulas to be used will be. Using ordinary time the total number of days in a year is assumed to be 30 days multiplied by 12 months ie 360 days.

Since the time period is 193 days we need to convert the number of days into an equivalent number of years. On November 15 1993 a woman borrowed 500 at 15. A P1 rt where P is the Principal amount of money to be invested at an Interest Rate R per period for t Number of Time Periods.

This leads to a situation where the application of the interest rate is based on 360 days. May 4 2002 - September 6 2002. Actually have 30 days.

The following indicates how to compute for the actual time and approximate time. When the amount of interest the principal and the time period are known you can use the derived formula from the simple interest formula to determine the rate as follows. Let us start by finding the amount of interest.

Ordinary Simple Interest or Bankers Rule Exact Simple Interest Remark. I Prt where P principal original sum r rate of interest and t time expressed in years. That being said the simple interest formula to calculate interest rate is.

The simple calculation is dividing 72 by the annual interest rate. - 5 4 2002. I PrtHere P denotes the principal r represents the rate of interest for one year and t is the time in years.

Exact time Month days 15 -November 30-1515 December 31 January 1994 31 20- February 20 TOTAL 97 DAYS Approximate time. For Bankers Rule we use ordinary interest with exact time. For ordinary interest one year is taken as 360 days approximate days in a year.

A combination of simple ordinary interest and actual time. M month D days Y year. The rule of 72 is found by dividing 72 by the rate of interest expressed as a whole number.

Included in the counting. F P1 rt sub e Maturity value using exact interest 365 for the approximate time. F P1 rt sub o Maturity value with ordinary interest 360 using approximate time.

Mathematicians have derived a way to approximate the value such a sum. P principal amount or the original amount being borrowed. Meaning of approximate and exact time.

Commercial firms and banks often use ordinary interest. For example a rate of 6 would be estimated by dividing 72 by 6 which would result in 12 years. Or in other words you are paid every possible time increment.

The rule is a shortcut or back-of-the-envelope calculation to determine the amount of time for an investment to double in value. First we get the exact and the approximate time. Using ordinary time the total number of days in a year is assumed to be 30 days.

Find the simple interest using the four methods. Actual time Number of days until the repayment date except the origin date. Ordinary interest D no.

4 months 2 days. Dont have the exact timeHe was born March 10 1940. SI P R T 100.

This guide teaches the most common formulas. The basic formula used to calculate simple interest is. 4 x 30 2.

The structure of exact interest is slightly different from ordinary interest. The debt is repaid on February20 1994. If the method of calculating interest is not given the Bankers Rule will prevail.

Use this simple interest calculator to find A the Final Investment Value using the simple interest formula. This video will discuss the process of getting the approximate and actual time and how the two are being used in getting the ordinary and exact interest. Thus each month from January to December has 30 days.

Those not qualifying the kind of interest needed are taken to mean ordinary interest. From 15 November to 15 February. SI PTR100 Here SI Simple interest P Principal sum of money borrowed R.

Problems on exact interest specify that the interest required is exact. Remember to use 1412 for time and move the 12. Time Years to Double an Investment.

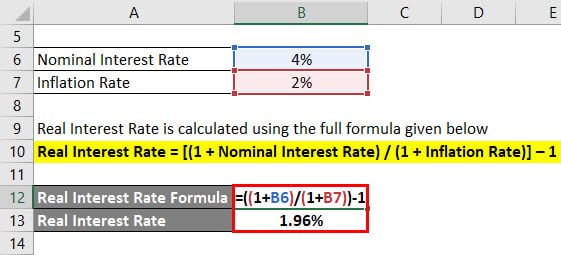

Real Interest Rate Formula Calculator Examples With Excel Template

Actual Approximate Time Interest Between Dates Mathematics In The Modern World Youtube

Ordinary And Exact Interest Using Approximate And Actual Time Part 2 Tagalog English Youtube