After each compound period the interest earned over that period is added to the principal so that the next calculation of interest includes the original principal plus the previously earned interest. Solve the questionssolved examples.

Compound Interest Calculator Markcalculate

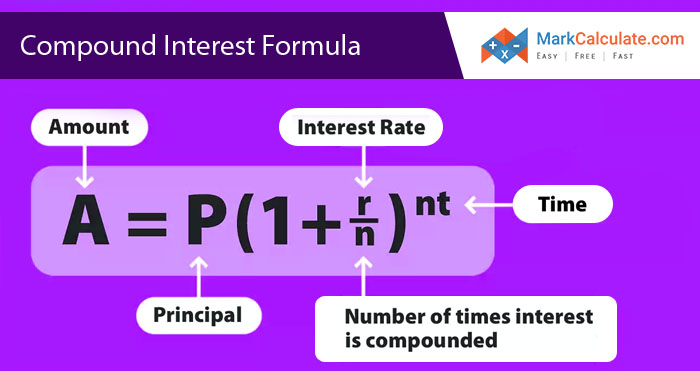

A P1 rt where P is the Principal amount of money to be invested at an Interest Rate R per period for t Number of Time Periods.

Exact compound interest calculator. A n is the amount after n years future value. Use this simple interest calculator to find A the Final Investment Value using the simple interest formula. Compound Interest CalculatorDaily To Yearly If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make a beginning monthly contribution of 500 annually increased by 0 after 15 years your savings account will have grown to 230629 -- of which 115000 is the total of your beginning balance plus.

R is the nominal annual interest rate. Compound Interest refers to earning or paying interest on interestAlthough it can apply to both savings and loans it is easiest to understand when thinking about savings. A 0 is the initial amount present value.

By using this website you agree to our Cookie Policy. How to Calculate Compound Interest. This calculator will solve for almost any variable of the continuously compound interest formula.

Daily compound interest is calculated using a simplified version of the compound interest formula. Simple interest is the interest calculation method that is least beneficial to savers and the most beneficial to borrowers. But if you want to know the exact formula for calculating compound interest then please check out the Formula box above.

Using the Compound Interest Calculator. The amount after n years A n is equal to the initial amount A 0 times one plus the annual interest rate r divided by the number of compounding periods in a year m raised to the power of m times n. The Simple Interest Calculation Formula is.

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Check your solutions with my thoroughly-explained solutions. 110 10 1 year 11.

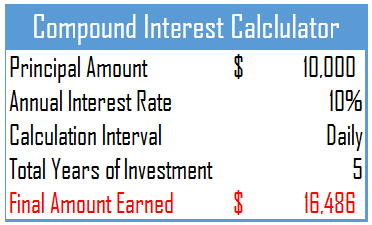

Thus the interest of the second year would come out to. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions. This compound interest calculator uses the compound interest formula calculator to find the principal amount plus the interest.

In other words the results of what you can achieve through the magic of. Download Compound Interest Calculator Excel Template. Investment Starting Amount - The lump sum at the beginning of the compounding periodIf you are modeling your portfolio use todays value.

Interest Rate - The annual percentage rate the. If you prefer investing money rather than time in figuring out how to calculate compound interest in Excel online compound interest calculators may come in handy. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100.

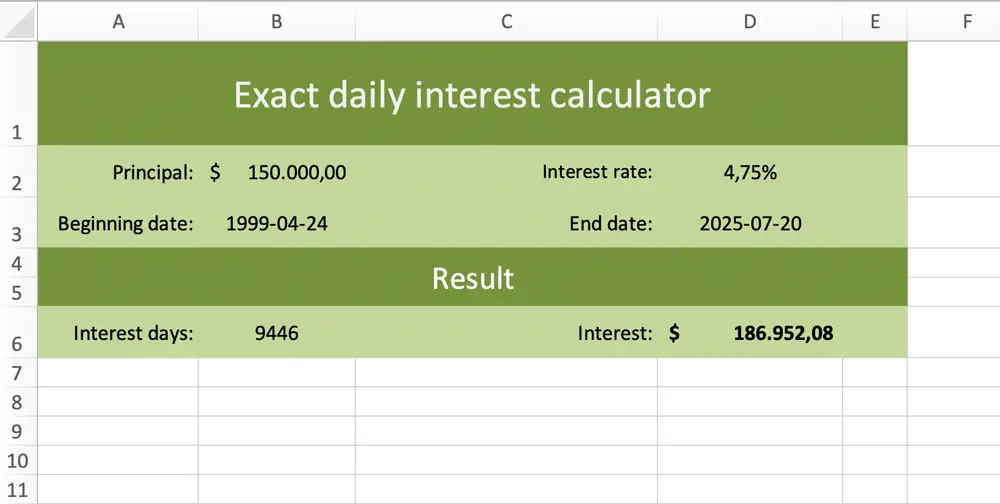

The time period is the exact number of days as computed by a Julian calendar even if multiple years are spanned also if leap years are involved. So fill in all of the variables except for the 1 that you want to solve. Click on Calculate.

Periodic Addition Frequency - How often you add that amount to your portfolio. This is in direct contrast to compound interest where accumulated interest is added back to the principal for each calculation so that you effectively earn interest on already accumulated interest. Simple Interest Compound Interest Present Value Future Value.

The above-mentioned formula is used to solve problems for rate time or principal given for the other known values. This calc will solve for A final amount P principal r. Lets be honest - sometimes the best compound interest calculator is the one that is easy to use and doesnt require us to even know what the compound interest formula is in the first place.

Periodic Investment Amount - The amount in dollars you add on a periodic basis. In addition to that the template also provides a complete schedule of payments and interests accumulating each payment period. The calculation is done in days EXACT calendar days.

But note if payments on a debt are paid as frequently as the compounding and the payment covers the interest due then even if the terms of the loan call for compounding there will be no impact on the total amount paid because at no point will there be any unpaid interest. Compound Interest Calculator is a ready-to-use excel template that helps to calculate compound interest with multiple compounding periods. Subtract the principal figure from your total if.

Included are options for tax compounding period and inflation. Compound interest calculators online. Continuous Compound Interest Calculator.

We start with A which is your investment horizon or goal. Determined values are the number of days involved in the transaction the interest total and the principal and interest total. The compound interest calculator determines how your money can grow using interest compounding.

Loan Amount in dollars and cents x Interest Rate x Time in days Total Interest You must select the values to enter the Starting Month Day and Year and the Ending Month Day and Year for the time of loan. It is the basis of everything from a personal savings plan to the long term growth of the stock market. Although it is easier to use online compound daily interest calculators all investors should be familiar with the formula because it can help you visualize investing goals and motivate you in terms of planning as well as execution.

Compound Interest Calculator - calculate compound interest step by step This website uses cookies to ensure you get the best experience. Free exact differential equations calculator - solve exact differential equations step-by-step. This is NOT compound interest.

A simple interest calculation takes a sum of money principal and calculates regular interest on that amount without the effect of compounding. This website uses cookies to ensure you get the best experience. Multiply your principal amount by one plus the daily interest rate as a decimal raised to the power of the number of days youre investing for.

Compound interest calculator for future value and APY Annual Percentage Yield calculations between user-specified exact dates. I think that the following can make other interested thats why I have programmed an interest calculator as a template. The total compound interest after 2 years is 10 11 21 versus 20 for the simple interest.

Exact Daily Interest Calculator as an Excel Template A few days ago I was asked by some reader to create an Excel template for the calculation of daily interest. M is the number of compounding. Check your answers with the calculators.

Simple Interest Exact Days Loan Calculator. I greet you this day Tue Nov 09 2021 044905 GMT-0800 Pacific Standard Time. By using this website you agree to our Cookie Policy.

You can find plenty of them by entering something like compound interest calculator in your preferred search engine. Also explore hundreds of other calculators addressing investment finance.

Compound Interest Calculator Daily To Quarterly Nerd Counter

Exact Interest Calculator As A Free Excel Template

Calculate Compound Interest In Excel Yearly Quarterly Monthly Daily