The basic formula used to calculate simple interest is. Thus each year has 365 days.

Actual Approximate Time Interest Between Dates Mathematics In The Modern World Youtube

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

How to get exact interest and ordinary interest. Exact time the correct number of days for each month is used. Hence 7 where D is the number of days or the time expressed in days. Principal 15000 Rate 6 Time 280 days 4 Calculate simple interest.

This note is for 3 months and 11 days. Find the ordinary interest on 1392 at 9 for 70 days. 1 year 12 months.

Get your calculator and check to see if youre right. 2 Find the actual time and approximate time from November 17 2005 to August 20 2006. When the number of days is given the following formula is used.

Actual and Approximate Time Examples Solution will be discussed during the lecture 1 Find the actual time and approximate time from June 7 to September 24 2005. The ratio of ordinary interest to exact interest is 1. Ordinary interest is based on the assumption of thirty days in each month of the calendar year.

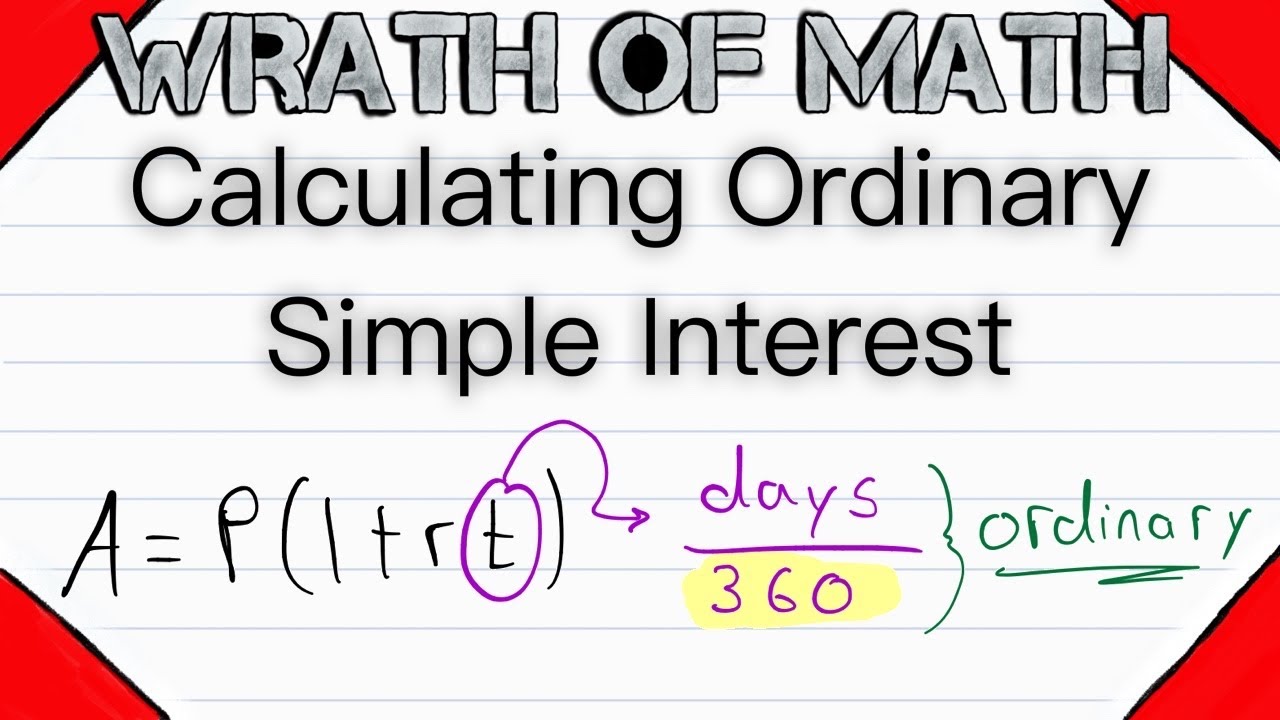

A P1 rt where P is the Principal amount of money to be invested at an Interest Rate R per period for t Number of Time Periods. 2 Calculate the interest from the periodic yield. The difference between the two bases when calculating daily interest on large sums of money can be substantial.

Actually have 30 days. The debt is repaid on February20 1994. If required round answers to the nearest cent.

2- Exact interest and exact time 3- Ordinary interest and approximate 4- Exact interest and approximate time Example. The ratio of ordinary interest to exact interest is 1. When using the exact date the total number of days in a year is 365 or 366 if it is a leap year.

Simple interest 50 Rate 5 Time 1 month 6 Calculate the interest rate. The general practice in Canada is to use exact interest whereas the general practice in the United States and in international business transactions is to use ordinary interest also referred to as the Bankers Rule. 1 month 30 days all months 1 year 360 days.

Determining the maturity value. Thus each year has 360 days. Calculate the four types of interest and maturity value as above for a RM4500.

Example 31 days for March 30 days for June and so on. Simple interest is the interest calculation method that is least beneficial to savers and the most beneficial to borrowers. On November 15 1993 a woman borrowed 500 at 15.

1 Adjust the quoted interest rate to get the periodic yield. Is widely used in the United States and uses the combination of ordinary interest and exact time. When the amount of interest the principal and the time period are known you can use the derived formula from the simple interest formula to determine the rate as follows.

2 Calculate exact interest. In contrast exact interest allows for the application to relate to the actual number of days found in the calendar year and not an average number of days per. OrdinaryApproximate time we assume each month to have 30 days even if that month does not.

In contrast exact interest is based on a 365-day year. If large sums of money are involved the difference can be significant. Ordinary simple interest is a SI that takes only 360 days as the equivalent number of days in a year.

1650 at 8 for 30 days. Principal 15000 Rate 6 Time 280 days 3 Calculate ordinary interest. Compute a the ordinary interest b the exact interest and c their difference.

First we get the exact and the approximate time. If large sums of money are involved the difference can be significant. Principal 8700 Rate 12 Time 2 years 5 Calculate the principal.

Lets calculate the amount of interest you will enjoy. Ordinary simple interest is computed on the basis of bankers year. Calculating Exact Interest Let denote the exact simple interest.

365 365 t Pit IePi Ie Example 9 Find the exact interest on 500 at 18 for 30 days. They are ordinary and exact simple interests. Ordinary interest assumes 360 daysyear or 30 daysmonth.

But note if payments on a debt are paid as frequently as the compounding and the payment covers the interest due then even if the terms of the loan call for compounding there will be no impact on the total amount paid because at no point will there be any unpaid interest. This leads to a situation where the application of the interest rate is based on 360 days. Since the time period is 193 days we need to convert the number of days into an equivalent number of years.

An investment of 5000 is made on August 31 and repaid on December 31 at an interest rate of 9 Applying the Bankers rule interest would be. Simple interest based on a 360-day year rather than a 365-day year. Ordinary interest - Investment Finance Definition Interest that is based on a 360-day year instead of a 365-day year.

Well work through this problem in two steps. Example 8 Find the ordinary interest on 324 at 5 for 40 days. Interest Simple Interest Exact and Ordinary Interest.

Interest is the sum paid for the use of money. Principal Rate and Time. Find the simple interest using the four methods.

In contrast exact interest is based on a 365-day year. Add up all 3 months and 11 days worth of interest. Divide 95 by 12 to get your monthly rate and use the 1630 ratio to get the interest earned on the 11 days.

Exact simple interest the correct number of days for each month is used. Simple interest can be considered as two categories when the time is considered in terms of days. The interest formulas for both ordinary and exact interest are actually the same with time slightly differing when given as number of days.

If the year is a leap year it has 366 days. OrdinaryApproximate simple interest we assume each month has 30 days. One year is equivalent to 365 days for ordinary year and 366 days for leap year.

Actual and Approximate Time Maturity Date Exact and Ordinary Interest. For example you deposit 3m for 90 days at a quoted interest rate of 4 based on a 360-day conventional year. T number of days 360 t number of days 365 CALCULATION TIP.

Ordinary interest where ie the year is taken as 360 days. ORDINARY INTEREST AND EXACT INTEREST When time is expressed in days interest could either be ordinary interest or exact interest. The ratio of ordinary interest to exact interest is 10139.

Business concerns and individuals who find themselves in need of cash or financial credit borrow money and agree to pay a certain percentage for the privilege of using the borrowed amount. Use this simple interest calculator to find A the Final Investment Value using the simple interest formula. Dictionary of Business Terms for.

I Prt becomes r IPt Remember to use 1412 for time and move the 12 to the numerator in the formula above. Simple Interest Formulas and Calculations. Ordinary interest - Investment Finance Definition.

For ordinary interest one year is taken as 360 days approximate days in a year. I Prt 5000009106360 13250. Exact simple interest is based on the actual number of days in a year.

Here P denotes the principal r represents the rate of interest for one year and t is the time in years. Interest that is based on a 360-day year instead of a 365-day year. The latter is called exact interest.

Calculating Exact Simple Interest Financial Mathematics Youtube

What To Buy From The Ordinary The Ordinary Anti Aging Skincare Routine Best Anti Aging Anti Aging Skincare Routine Anti Aging

Calculating Ordinary Simple Interest Financial Mathematics Youtube