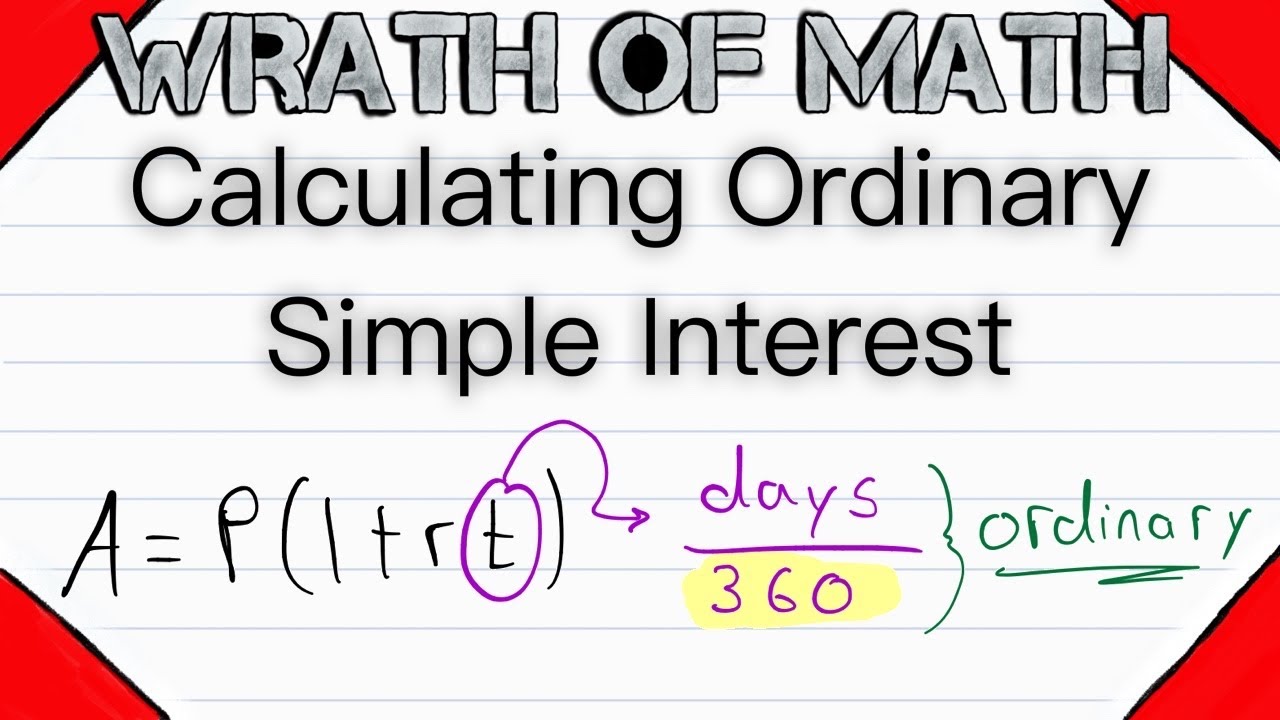

Calculating Ordinary Interest Two ways for calculating Ordinary interest 1 By formula. We use the formula MV FV1rt to solve problems of simple interest notes EXAMPLES.

The Ordinary Niacinamide 10 Zinc 1 Review Blush Pearls Skin Care Solutions Affordable Skin Care Oily Skin Care

March 1 1994 300000 June 1 1994 200000.

3- ordinary interest and exact interest. 2500 x 1175 x 135365 10865 2500 principal 10865 interest 260865 total loan payoff with exact interest. Simple interest is the interest calculation method that is least beneficial to savers and the most beneficial to borrowers. 2 By 6 for 60 days method.

Principal 15000 Rate 6 Time 280 days 4 Calculate simple interest. But note if payments on a debt are paid as frequently as the compounding and the payment covers the interest due then even if the terms of the loan call for compounding there will be no impact on the total amount paid because at no point will there be any unpaid interest. Bankers year 1 year 12 months 1 month 30 days all months 1 year 360 days Exact simple interest is based on the actual number of.

Wiki User 2011-11-03 234336. A simple interest note for Php 25000 with interest at 16 per annum was signed on January 12 2012 and due on April 25 2012. In contrast exact interest is based on a 365-day year.

Identify the given information FV25 000 Origin Date. Interest is the sum paid for the use of money. Ordinary interest where ie the year is taken as 360 days.

The calculation is done in days EXACT calendar days. Ordinary interest is calculated on the basis of a 360-day year or a 30-day month. 2 Calculate exact interest.

Principal 8700 Rate 12 Time 2 years 5 Calculate the principal. Exact interest where ie the year is taken as 365 days leap year or not. First Savings and Loan charges 725 ordinary interest while Wells Bank charges 75 exact interest.

When simple interest ordinary or exact is not specified in any problem it is assumed as ordinary. The latter is called exact interest. If on conversion of a market discount bond issued after July 18 1984 or issued on or before July 18 1984 and purchased after April 30 1993 a taxpayer receives stock in the issuer of the bond the amount of market discount accrued to the date of exchange must be treated as ordinary interest income upon sale or disposition of the stock unless the taxpayer had elected to include in income market discount.

T number of days 360 t number of days 365 CALCULATION TIP. The builder of an apartment building obtained an 800000 construction loan at an annual rate of 15. Ruth wants to borrow 21600 for 120 days to pay her real estate tax.

When calculating the ordinary interest I by the Bankers Rule the formula becomes. 2500 x 1175 x 135360 11016 ordinary interest 2500 principal 11016 interest 261016 total loan payoff with ordinary interest Exact interest. The money was advanced as follows.

CHAPTER 1 SIMPLE INTEREST AND SIMPLE DISCOUNT 3 When the time is given in days there are two different varieties of simple interest in use. January 12 2012 R 16 per annum Maturity date. Exact Approximate Time Example 2 Find a the exact time and b the approximate time from November 14 1996 to April 24 1997.

Loan Amount in dollars and cents x Interest Rate x Time in days Total Interest You must select the values to enter the Starting Month Day and Year and the Ending Month Day and Year for the time of loan. Ordinary simple interest is a simple interest that uses 360 days as the equivalent number of days in a year. Ordinary simple interest is a SI that takes only 360 days as the equivalent number of days in a year.

Interest that is based on a 360-day year instead of a 365-day year. If the number of days is given the days should be expressed as a fraction of a year. Exact Approximate Time 365 Approximate time 365 Exact time 360 Approximate time 360 Exact time 4 3 2 1 for computing ordinary interest for computing exact interest Bankers Rule.

Ordinary simple interest is computed on the basis of bankers year. 053333333333 ordinary interest. Simple interest can be considered as two categories when the time is considered in terms of days.

The ratio of ordinary interest to exact interest is 10139. The interest formulas for both ordinary and exact interest are actually the same with time slightly differing when given as number of days. 3Ordinary interest and approximate 1979 360 95 I 500u 015 u 4Exact interest and approximate time 1979 365 95 I 500u 015 u Example.

Exact interest is calculated on a 365-day year. If large sums of money are involved the difference can be significant. The difference between the two bases when calculating daily interest on large sums of money can be substantial.

Ordinary interest is based on the assumption of thirty days in each month of the calendar year. April 25 2012 Step 2. On the other hand Exact simple interest is a simple interest that uses exact number of days in a year which is 365 or 366 for leap year.

Add up all 3 months and 11 days worth of interest. Interests and discounts Notes interest and discount ordinary and exact sdiple interest qrdlnary simpie interest is computed on the basis of which is one. The ratio of ordinary interest to exact interest is 1.

Find the maturity value. Simple interest 50 Rate 5 Time 1 month 6 Calculate the interest rate. 360 360 I Pi tPit Example 3 Find the ordinary interest on 500 at 18 for 30 days.

So ordinary interest is 30 days collecting or gathering interest on a dollar and exact is collecting or gathering 1 year interest on a dollar. Enter the amount of the loan and the simple interest rate. Ordinary interest - Investment Finance Definition.

They are ordinary and exact simple interests. Simple interest based on a 360-day year rather than a 365-day year. In contrast exact interest allows for the application to relate to the actual number of days found in the calendar year and not an average number of days per month within that year.

This leads to a situation where the application of the interest rate is based on 360 days. Principal 15000 Rate 6 Time 280 days 3 Calculate ordinary interest. Divide 95 by 12 to get your monthly rate and use the 1630 ratio to get the interest earned on the 11 days.

Additionally what is the difference between exact interest and ordinary interest. This video will discuss the process of getting the approximate and actual time and how the two are being used in getting the ordinary and exact interest. This note is for 3 months and 11 days.

Calculating Exact Simple Interest Financial Mathematics Youtube

Calculating Ordinary Simple Interest Financial Mathematics Youtube

The Ordinary The Affordable Skincare Company That Is Taking Over Affordable Skin Care Natural Hair Mask Skin Care