Also called simple interest. The difference between the two bases when calculating daily interest on large sums of money can be substantial.

12 3 Perpetuities Mathematics Libretexts

This note is for 3 months and 11 days.

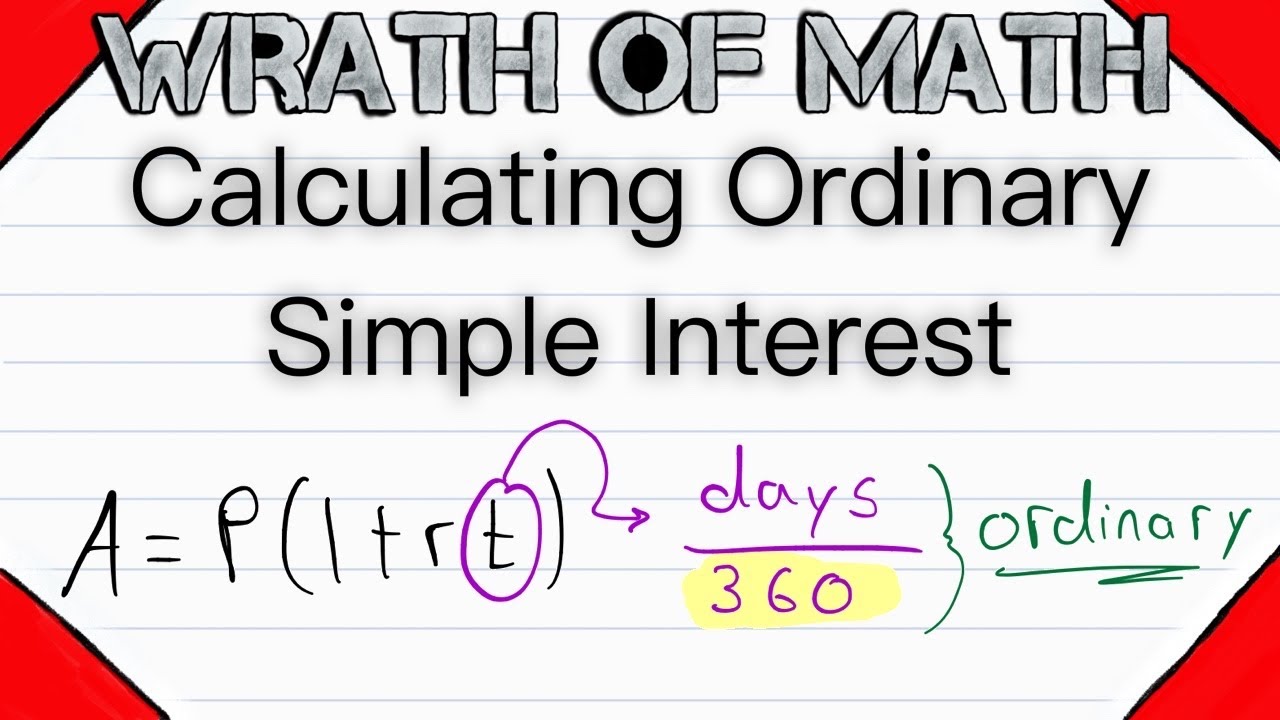

Ordinary interest and exact interest difference. Ordinary interest assumes 360 daysyear or 30 daysmonth. Tutorial about Ordinary Interest Using Exact and Approximate Time. Ordinary simple interest is a SI that takes only 360 days as the equivalent number of days in a year.

The ratio of ordinary interest to exact interest is 1. Interest that is calculated and therefore repaid on the basis of a 360-day year as opposed to a full 365-day year. The ratio of ordinary interest to exact interest is 10139.

OrdinaryApproximate time we assume each month to have 30 days even if that month does not. Interest computed using a divisor 360 is called ordinary interest. What is the difference between exact interest and ordinary interest.

When using the exact date the total number of days in a year is 365 or 366 if it is a leap year. While this is only a small difference in calculation the difference in amount can be large especially with large debt transactions. Substituting r 015 I P 300 and t 600 days in the next formula.

If large sums of money are involved the difference can be significant. We can therefore conclude that ordinary interest is greater than exact interest. The calculation of ordinary interest versus exact interest are very similar.

To illustrate if a person has taken a loan of 800 for a period of 90 da View the full answer. The difference between exact interest and ordinary interest is described below. Exact interest is calculated on a 365-day year.

In contrast exact interest allows for the application to relate to the actual number of days found in the calendar year and not an average number of days per month within that year. Ordinary interest is calculated on the basis of a 360-day year or a 30-day month. This leads to a situation where the application of the interest rate is based on 360 days.

Definition of Exact InterestInterest paid based on the basis of a 365-dayyear schedule by a bank or other financial_institution as opposed to a 360-day basis ordinary interestDifference can be material when large principal sums of money are involved. Thus each month from January to December has 30 days. Exact interest is calculated on a 365-day year.

With ordinary simple interest the denominator is 360 and in exact simple interest the denominator is either 365 or 366. In contrast exact interest is based on a 365-day year. The interest formulas for both ordinary and exact interest are actually the same with time slightly differing when given as number of.

Simple interest based on a 360-day year rather than a 365-day year. If large sums of money are involved the difference can be significant. Actually have 30 days.

Figure the ordinary and exact interest on a 60 days loan of 300 if the rate is 15. With the increase of computers in banking do you think that the ordinary interest method is a dinosaur in business today. Compute a the ordinary interest b the exact interest and c their difference.

Ordinary interest is calculated on the basis of a 360-day year or a 30-day month. Round answers to the nearest cent. See full answer below.

The ratio of ordinary interest to exact interest is 1. The only difference is that you use 365 days for exact interest and 360. Interest computed using a divisor 365 or 366 is called exact interest.

Ordinary interest - Investment Finance Definition. The latter is called exact interest. The interest formulas for both ordinary and exact interest are actually the same with time slightly differing when given as number of.

Ordinary interest is also based on 12 months with each month being 30 days exactly. Interest that is based on a 360-day year instead of a 365-day year. Ordinary interest is calculated on the basis of a 360-day year or a 30-day month.

Divide 95 by 12 to get your monthly rate and use the 1630 ratio to get the interest earned on the 11 days. The interest formulas for both ordinary and exact interest are actually the same with time slightly differing when given as number of days. Interest is the sum paid for the use of money.

The difference between ordinary interest and exact interest is that ordinary interest goes by 360 days per year and exact interest goes by 365 days per year. Interest that is based on a 360-day year instead of a 365-day year. Principal Rate and Time.

Ordinary interest is based on the assumption of thirty days in each month of the calendar year. On the other hand exact simple interest is a SI that takes exact days in 365 for a normal year or 366 for a leap year. Ordinary interest will be higher because there is less days per year on it than exact interest.

They are ordinary and exact simple interests. Exact Interest The exact interest is calculated by taking into account 365 days in a year. Definition of Exact Interest Interest paid based on the basis of a 365-dayyear schedule by a bank or other financial_institution as opposed to a 360-day basis ordinary interest.

When simple interest ordinary or exact is not specified in any problem it is assumed as ordinary. 2625 at 5 for 120 days. Tutorial about Ordinary Interest Using Exact and Approximate Time.

Add up all 3 months and 11 days worth of interest. Exact interest is calculated on a 365-day year. In contrast exact interest is based on a 365-day year.

Regimen Guide The Ordinary Regimen Antioxidant Serum Regimens

Calculating Ordinary Simple Interest Financial Mathematics Youtube

Retinoid Vs Retinol The Best Types Of Vitamin A For Your Skin The Skincare Edit Retinoid Retinol The Ordinary Retinol